We started this series last year, and we’re finally getting around to concluding it. Apologies if you’ve been waiting. Thank you for your patience.

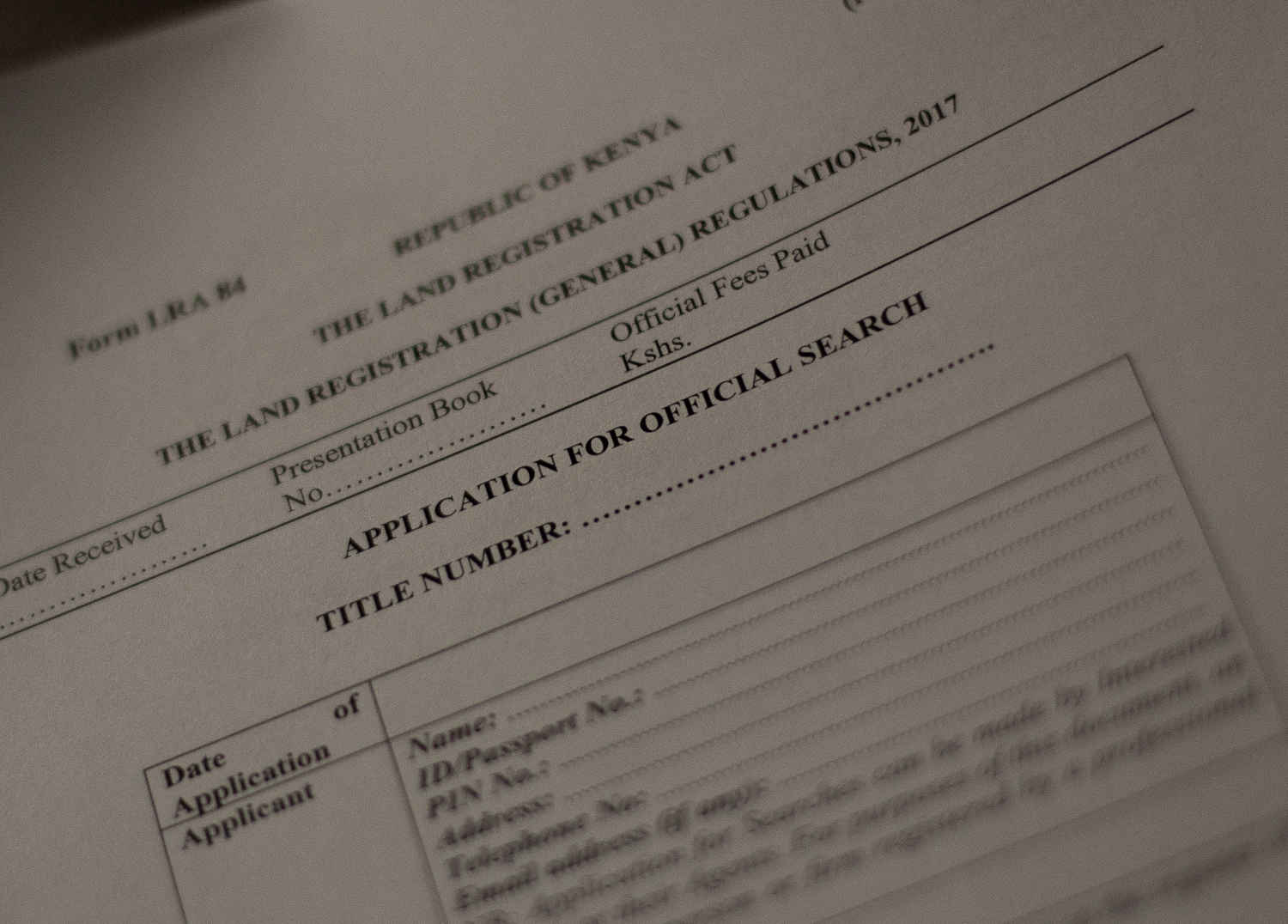

In Part 1, we highlighted the three main steps to completing the due diligence process for a land purchase. Starting with the process of land scouting, doing a land search and the process of obtaining a green card to verify ownership and ensure there are no encumbrances on the title in question.

This post will dive a little deeper into those steps to give you additional information to consider throughout the process.

On verifying the identity of the owner: Talking to the Neighbours

As far as your land scouting goes, when you talk to the neighbours of the property you’re looking to invest in, they’ll confirm the owner’s actual identity. Another important piece of information that may not necessarily come out when you do a title search is the history of ownership of the property and the circumstances around it.

For example, we once did a site visit on a particular property and while interviewing the neighbours, we discovered that the property owner and his brothers were not at peace with one another. This affected our decision to purchase the land. Even though everything was sound as far as documentation was concerned, we liked the owner and the pricing was right. The place was beautiful. We found out that their father had left them the land as an inheritance and they had a dispute about the boundary. They could not agree on where the first brother’s property ended and the second brother’s started.

So, every time both brothers were on their property, they would have fights and quarrels that would escalate to dangerous levels. We pulled out of the transaction simply because we didn’t want to invest our money in a place we may not be able to access because of family disputes. There is no way a document from the Ministry of Lands Office will give you that information. That’s another critical reason why it’s good to talk to neighbours.

Get consent.

Once you have verified the identity of the owner, get a certified copy of their identification. Then ensure all concerned parties have given consent for the sale of the property. If the seller is married (includes traditional marriages), their spouse must sign a consent. Though not required by the law, in specific circumstances, especially if there is a family dispute, it may be prudent to get the consent of all adult children as well (18 years and above).

There are two ways to do this. One way is for your advocate to include their particulars in the sale agreement and have them sign to consent to the sale. Another is to create separate documents that detail the transaction to be signed individually to consent to the property’s sale. If the seller has more than one wife at the time of the sale, all wives must consent to the sale. If one of them does not, they can later contest the sale in court, and you could lose the property.

Pricing Wisdom

Talking with neighbours will also give you a good indication of the general pricing for the area. But do not get hung up on whether the price the seller is asking you to pay is higher than the general area. The reason is simply that sometimes it’s worth your while to pay slightly more for the right property in the right location, especially if all the documents are in order.

There are instances where we have paid up to 30% higher on a particular property than the one next to it simply because the documents were in order, there were no issues in the family, and the location worked for us. And yes, you may also get a good deal by simply asking, but I wouldn’t let that be a stumbling block, should the investment of that particular property make sense for you.

About the deposit

According to the Law Society of Kenya policies, a legal deposit should be at least 10% of the purchase price. Very simple. It doesn’t have to be 10%. Sometimes you can pay more. We’ve generally paid more just because the seller had specific needs and we were comfortable with the due diligence to pay slightly more.

A deposit of less than 10% of the agreed price, legally speaking, voids the sale agreement. It will not be a legal sale agreement within the country of Kenya. It is crucial to pay the right amount of deposit. The less you can pay, the better, of course, to reduce your risk in case of issues later, but not less than the legally required amount of 10%.

Thank you so much for taking the time to read this post. Part 3 will be out later this week, it will cover some important information in regards to representation and making sure you are covered should a dispute arise. If you have any questions on this topic please feel free to reach out to us by leaving a comment below.

Be the first to comment!